Personal Finance Is Not About Math—It’s About You

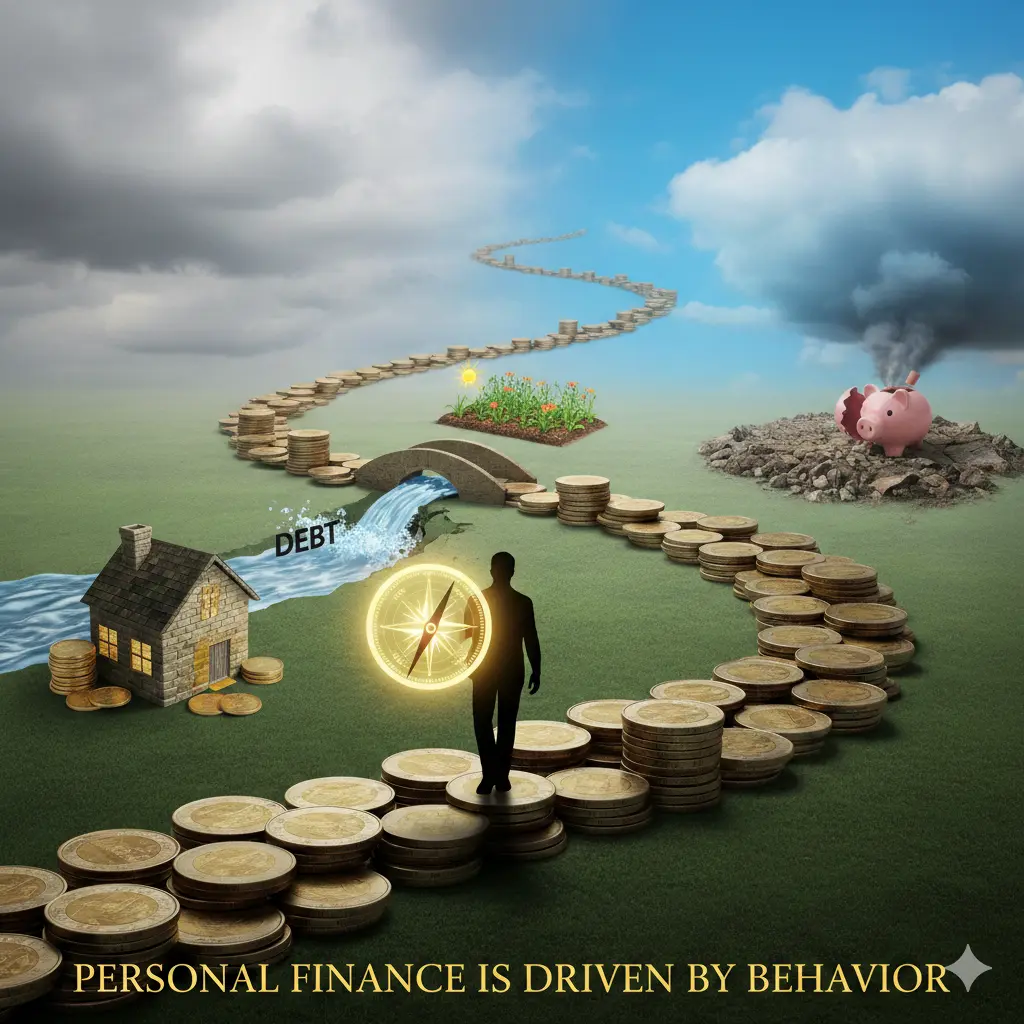

When people think about personal finance, they often assume it’s all about numbers, spreadsheets, and complex strategies. But in reality, personal finance is far more dependent on behavior than on income, intelligence, or financial knowledge.

I’ve seen this firsthand—both in my own financial journey and while observing others. Two people can earn the same amount of money, live in similar circumstances, and have access to the same financial tools. Yet one builds long-term wealth while the other struggles paycheck to paycheck. The difference is rarely luck. It’s behavior.

This guide explores why personal finance is dependent upon your behavior, how everyday decisions shape financial outcomes, and how you can change your habits to build lasting financial stability and wealth.

What Does “Personal Finance Depends on Behavior” Really Mean?

Personal finance behavior refers to how you think, feel, and act around money. This includes:

- Spending habits

- Saving consistency

- Risk tolerance

- Emotional responses to money

- Decision-making under stress

- Long-term discipline

Unlike technical knowledge, behavior operates every day, often subconsciously.

You don’t fail financially because you don’t know how budgeting works.

You fail because you don’t follow the budget when emotions take over.

The Psychology Behind Money Decisions

Emotional Triggers Drive Financial Choices :

Most financial decisions are emotional, not logical. Common emotional triggers include:

- Fear (panic selling, avoiding investing)

- Greed (overspending, chasing trends)

- Stress (impulse buying)

- Overconfidence (taking excessive risks)

I personally struggled with emotional spending early on. After long workdays, I justified purchases as “rewards.” The cost wasn’t just money—it was delayed progress toward my financial goals.

Instant Gratification vs Long-Term Thinking

Human behavior naturally prefers immediate pleasure over future benefits. This explains why:

- Saving feels hard

- Debt feels easy

- Long-term investing feels boring

Behaviorally strong individuals train themselves to delay gratification, even when it’s uncomfortable.

Why Income Alone Doesn’t Guarantee Financial Success

High Income, Poor Behavior = Financial Stress :

Many high earners live with constant financial pressure. Why?

- Lifestyle inflation

- Lack of savings discipline

- Emotional spending

- Overreliance on credit

I’ve met people earning modest incomes who felt financially secure—and others earning much more who felt trapped. Behavior, not income level, explained the difference.

Low Income, Strong Behavior = Financial Progress

Good behavior can compensate for limited resources through:

- Intentional budgeting

- Consistent saving

- Controlled spending

- Strategic planning

Personal finance is not about how much you make—it’s about how much you keep and grow.

Crypto for Beginners – A Complete Step-by-Step Guide

How Spending Behavior Shapes Your Financial Reality

Mindless Spending Is the Silent Wealth Killer

Most financial leaks happen in small, repeated expenses:

- Subscriptions you forgot about

- Daily convenience purchases

- Emotional “treat yourself” moments

- Pausing before purchases

- Asking if spending aligns with goals

- Differentiating needs from wants

One habit that transformed my finances was waiting 24 hours before non-essential purchases. The result? Fewer regrets and more savings.

Saving Money Is a Behavioral Skill, Not a Financial Trick

Why Most People Struggle to Save :

Saving fails when it relies on motivation instead of systems. Motivation fades. Behavior remains.

Common saving challenges include:

- “I’ll save what’s left” mindset

- Inconsistent habits

- Emotional justification for spending

- Automate savings

- Treat savings as non-negotiable

- Start small and increase gradually

When I automated savings, I stopped debating with myself. The money was gone before temptation arrived.

Investing Success Depends More on Discipline Than Strategy

Many investors lose money not because of bad assets—but because of bad behavior:

- Panic selling during downturns

- Chasing hype

- Overtrading

- Ignoring long-term plans

- Staying consistent

- Ignoring short-term noise

- Rebalancing calmly

- Trusting the process

Successful investing behavior includes:

The hardest part of investing isn’t choosing investments—it’s not interfering emotionally.

Debt Is a Behavioral Problem Disguised as a Financial One

Why Debt Keeps Repeating :

Debt cycles are driven by behavior such as:

- Using credit for emotional relief

- Avoiding financial discomfort

- Normalizing borrowing

I once justified debt as “temporary.” It became permanent until I changed my behavior—not my income.

Behavioral Shifts That Break Debt Cycles

- Stop emotional spending

- Track triggers

- Replace avoidance with awareness

- Commit to progress, not perfection

The Role of Habits in Long-Term Financial Success

Small Habits Create Massive Results :

Daily behaviors compound over time:

- Tracking expenses weekly

- Reviewing goals monthly

- Adjusting plans annually

These habits feel boring—but boring behaviors build extraordinary financial outcomes.

Consistency Beats Intensity :

Financial success doesn’t come from extreme effort. It comes from repeating simple behaviors consistently.

How Identity Shapes Financial Behavior

You Act According to Who You Believe You Are :

If you believe:

“I’m bad with money”

“I’ll never be wealthy”

“Money always disappears”

Your behavior will confirm it.

Identity-Based Financial Growth

Change statements like:

“I can’t save” → “I’m learning to manage money”

“Investing is risky” → “I’m a long-term thinker”

When I started seeing myself as a “financially responsible person,” my decisions aligned naturally.

Behavioral Framework for Better Personal Finance

No 1: Awareness

Track spending and emotional triggers without judgment.

No 2: Systems

Automate savings, bills, and investments.

No 3: Environment Design

Remove temptations. Reduce friction for good behavior.

No 4: Reflection

Review progress regularly and adjust calmly.

Common Behavioral Mistakes That Hurt Personal Finance

- Waiting for motivation instead of building systems

- Copying others without self-awareness

- Ignoring emotional triggers

- Focusing on shortcuts instead of habits

Awareness of these mistakes is the first step toward change.

The Long-Term Impact of Financial Behavior

Over time, behavior determines:

- Net worth growth

- Stress levels

- Financial freedom

- Quality of life

- Future options

Money amplifies behavior. Good behavior leads to security. Poor behavior leads to anxiety—regardless of income.

Conclusion: Master Your Behavior, Master Your Money

Personal finance is not about perfection. It’s about consistent, intentional behavior over time.

You don’t need to be an expert.

You don’t need to earn more immediately.

You need to align your daily actions with your long-term goals.

From my own experience, the moment I focused on behavior instead of tactics, everything changed. Financial peace followed—not because life became easier, but because my decisions became stronger.

If you want to improve your personal finance, start here:

Change how you behave with money—and the numbers will follow.

How to Track Expenses and Increase Savings

FAQ :

Why is personal finance more about behavior than knowledge?

Because knowing what to do doesn’t guarantee doing it. Behavior determines whether knowledge is applied consistently.

Can good financial behavior overcome low income?

Yes. While income matters, strong financial habits can create stability and growth even with limited resources.

How long does it take to change financial behavior?

Behavioral change begins immediately but compounds over months and years through consistent habits.

What is the biggest behavioral mistake in personal finance?

Emotional decision-making—especially during stress or uncertainty.

How can I improve my financial behavior starting today?

Start by tracking spending, automating savings, and reflecting on emotional triggers without judgment.